What is technical analysis in trading? Blog

Contents:

Forex traders are always going to have a preference for one type of Forex market analysis over another. This is where the use of technical indicators can help remove some of that subjectivity, at least from a risk management perspective. Almost all of the most important Forex news releases that you find on an economic calendar will have an effect on monetary policy and fundamental analysis requires you to pay attention. Each Forex trader has a different personality and trading style, but the most important thing in markets is to be informed. We’ve separately explored each of the three types of Forex analysis and offered indicators to help you create a trading strategy that lets you combine the best of each.

When the prices of the two stocks move in a similar direction, they are correlated, or dependent. When the price of two commodities consistently move in opposite directions, they are negatively correlated. Two stocks moving independently of each other without any correlation can help with portfolio diversification. This is because when some shares in a portfolio are losing money, other non-correlated shares might still be gaining.

Understanding the different types of forex trading strategies – Ripples Nigeria

Understanding the different types of forex trading strategies.

Posted: Wed, 29 Mar 2023 16:04:43 GMT [source]

Gain insights into market sentiments before you perform your technical analysis with CAPEX news sentiment – that way, you’ll know where to look that day. If you have chosen a short strategy – say, a 15 or 50-day moving average – you’ll be looking at highly liquid and volatile markets such as cryptocurrencies or certain stocks. Deploy your charts provided by CAPEX and attempt to uncover a pattern that indicates price movement in the fashion that you would like. When your technical analysis produces a signal, feel free to open a position in accordance with your strategy and imposed limitations. Don’t forget you can use stop-loss and profit target orders to control your losses and profit potential. In fundamental analysis, indices are used to determine the sentiment on a particular market.

How to use fundamental analysis on indices?

All these resources are completely free and instantly available upon sign-up at CAPEX. Learning new concepts about trading approaches and the stock market is critical to your success as a trader. Low float stocks are a type of stock with a limited number of shares available for trading, which tends to cause… Understanding fundamentals can help you gauge the legitimacy of certain price action. You may want to understand the legitimacy of the move before deciding whether it is a short or long play. If the stock is breaking out because it doubled its earnings estimate, you may want to hold off on your short position.

Traders can use these reports to understand the market fundamentals and make assumptions on future commodity value. Finding an asset’s intrinsic value is one of the most important elements when performing fundamental analysis on an asset. Many traders conduct both types of analysis when using fundamentals so neither qualitative nor quantitative is better than the other. Many fundamental analysts consider that both qualitative and quantitative analysis work together to provide a more in-depth analysis.

Elliot Wave analysis: SP500, AAPL, AMZN, NVDA, TSLA, GOOGL, BRK.B, SQ, META

There are several types of technical analysis you can apply to the Forex markets, all of which have specific strengths and weaknesses. However, the best type of technical analysis for a trader will consider their psychology, risk tolerance, and ability to recognize the attitude of the market. There is no “one-size-fits-all” type of technical analysis, so testing systems and indicators that you are interested in and seeing how it works is the only way to find your best path. Let’s say you are considering entering a long trade based upon a bullish candlestick pattern, but you feel unsure about it as the pattern does not look optimally strong. A solution might be to have a policy of only entering a long trade when, say, the RSI indicator has a 20-period reading greater than 50.

- Beneath that, you can also do an on-chain analysis, where you look at key trends in the specific crypto.

- But how do you know what currency pair to trade and how do you actually decide when to buy and sell currency pairs in forex trading?

- It can be applied to any type of content or data, including social media, reviews, articles etc., and it can be used to understand the general feeling around a certain topic.

Sign up for a https://trading-market.org/ to hone your strategies in a risk-free environment. Depending on whether a country is classified as a developed or developing country, Central Bank interest rates will generally differ. For example, since the 2008 global economic recession most developed countries have had very low interest rates, while developing countries have largely maintained quite high interest rate levels. Interest rates levels are usually an indicator of the Central Bank’s confidence in a country’s economy. In the list below we have elements of qualitative fundamentals that you need to consider when performing this type of analysis of an asset.

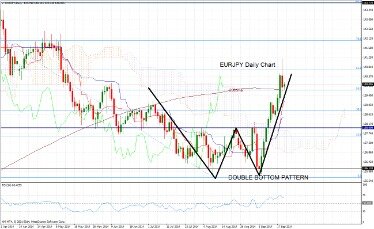

Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Reversal patterns signal there is a potential change in the current trend of an asset. The most common reversal patterns are the reverse head and shoulder, double or triple top/bottom, wedges, and the rounding top/bottom. A support level is usually a level where the bulls take control over the bears, stopping prices from falling. Conversely, a resistance level is a level at which the bears take control to stop the price from rising further.

A Must-ReadeBook for Traders

Within this pattern, a short term uptrend line will converge with a short term downtrend line to form a triangular point that looks like a pennant. A volume increase will then continue the prevailing trend, causing it to stand out as a brief pause. You are dealing with indicators,support/resistance,candlestick patterns, Fibonacci ratios, RSI,Stochastic, and more. In order to become a true forex trader, you will need to know how to effectively use these three types of market analysis. And as you’ll find out in later lessons, identifying trends is a huge part of technical analysis.

Introducing ElcomercioIX: A New Trading Broker – Yahoo Finance

Introducing ElcomercioIX: A New Trading Broker.

Posted: Wed, 29 Mar 2023 14:45:00 GMT [source]

The following lessons can be applied to your technical trading strategy to help you improve your trading results. We all make rapid decisions daily whether we are conscious of them or not. We simplify seemingly complex situations by employing decision-making tools and strategies. In day trading, technical analysis is one of the most effective strategies for simplifying large amounts of data in order to ease the decision making process. There are several different types of price charts traders can use to navigate the markets and an endless combination of indicators and methods with which to trade them.

Technicians use these surveys to help types of technical analysis in forex whether a trend will continue or if a reversal could develop; they are most likely to anticipate a change when the surveys report extreme investor sentiment. Surveys that show overwhelming bullishness, for example, are evidence that an uptrend may reverse; the premise being that if most investors are bullish they have already bought the market . And because most investors are bullish and invested, one assumes that few buyers remain.

Certain combinations of candles create patterns that traders may use as entry or exit signals. The cost of trading and technical analysis tools will vary by provider and the scope of the software’s features. Trading software varies based on who creates it and how it is to be used. Many times trading software will be distributed by a trading platform, and the software will be proprietary to that platform. The software will interface with the trading platform, in many cases, to allow traders to place trades to buy and sell.

For example, should political climates change rapidly and redefine political risk, there may be an unpredictable impact to investments no previously foreseen. Technical analysis is only possible if a company’s historical stock price can be used to predict future price movement. Sentiment analysis has several advantages and limitations in comparison to the other methods, technical analysis and fundamental analysis, of analyzing securities for trading. Two of the most heavily traded markets for U.S. investors are the foreign exchange market and the domestic stock market. Therefore, it is critical to understand how to perform fundamental analysis in each of these two markets properly.

Because the retail traders are very small participants in the overall forex market, so no matter how strongly you feel about a certain trade , you cannot move the forex markets in your favour. Technical analysis helps in the prediction of future market movements based on the information obtained from the past. The market’s momentum can easily reverse or an extreme volatility can be seen in a matter of minutes after an important announcement or press release is made by the central bank. Information related to the status of the local and global economies can have huge impact on the direction in which the forex market trends. Traders can conduct as much or as little analysis as they like of any type of strategy or technique. It is the trader’s decision to include multiple trading analysis techniques or just one into their overall trading strategy.

Technical Analysis For Trading Discover Technical Analysis At CAPEX

This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice. However, this doesn’t mean all patterns are accurate, and candlesticks represent tendencies, not guarantees, in price movements. A chart with price and trading volume data is thus a reflection of the market sentiment rather than fundamental factors. It can help traders to forecast and assume what is likely to happen in the future by looking at past information.

If a stock is trading at $10, with support at $9 and resistance at $15, you can place a trade where you risk $1 to make $5. These price levels are what allow traders to gauge the potential risk and reward of a trade. You should also keep in mind that support and resistance levels are NOT guaranteed to hold. Webull has advanced charting and screening tools that allow investors and traders to analyze market activity across geographic regions and investment types. These features are available through desktop as well as Webull’s mobile app. For crypto traders, the site also offers direct access to a number of cryptocurrencies.

Those who access this site do so on their own initiative, and are therefore responsible for compliance with applicable local laws and regulations. The release does not constitute any invitation or recruitment of business. So, they may go to the futures market and locking at a fixed rate of cocoa as their raw material.

Candlesticks present the battle between buyers and sellers in a very simple-to-interpret graphical way. Candlestick charts also have their own range of patterns, with many focusing on the psychology of the market and constant battle between buyers and sellers. Some stock movements are dependent on each other, with a clear relationship. This correlation and dependence can be of interest in technical analysis.

There are so many other factors such as what’s already been priced in, market positioning and overall sentiment. This is a simple, yet effective Forex news indicator that has been designed to keep things as brief as possible for traders. The most important piece of fundamental news to Forex markets, is monetary policy and how a central bank’s decision to hike or lower interest rates will affect demand. The information provided herein is for general informational and educational purposes only.